Dedicated to transforming lives

I help women look good and feel great so that they can increase self-confidence, self-love and live a happy and exciting life! I do this by providing customised coaching services that help them take inspired action and achieve their goals.

LIVES IMPACTED ONLINE

TRANSFORMATIONS TO-DATE

NUTRITION PLANS TO-DATE

Dedicated to transforming lives

I help women look good and feel great so that they can increase self-confidence, self-love and live a happy and exciting life! I do this by providing customised coaching services that help them take inspired action and achieve their goals.

LIVES IMPACTED ONLINE

TRANSFORMATIONS TO-DATE

NUTRITION PLANS TO-DATE

WHAT IS YOUR CUSTOM WEIGHT LOSS NUMBER?

Discover Your Exact Caloric Intake to Achieve Your Dream Body in record time!

WHAT IS YOUR CUSTOM WEIGHT LOSS NUMBER?

Discover Your Exact Caloric Intake to Achieve Your Dream Body in record time!

JANE MUKAMI

WHO IN THE WORLD IS JANE?

I was born and raised in Nairobi, Kenya and moved to Atlanta, GA in November 1999 in pursuit of higher education.

After divorce in 2008, I struggled with low self-confidence, self-worth, plummeted into depression and turned to food for comfort. A rude awakening made me commit to reclaiming myself by changing how I looked and how I felt.

My fitness journey transformed my body, my life and ignited my passion for health and fitness. I’ve since made it my mission to help women lose weight, look good, feel great, so that they can confidently live happy and exciting lives.

Achievements:

Creator of The P.U.S.H Weight Loss Method

Founder of 21 Days of Change – one of the largest health & fitness Facebook Groups for women with over 310,000 active members and other groups with a total of 625,000 members

250,000 combined Pounds lost over the last 4 years from 21,000 members

Certified health coach from Health Coach Institute US

Awards & Recognition:

Health & Fitness Award 2019 ACHI Awards – Atlanta USA

Influencer Award 2019 Journey Awards – Atlanta USA

Named Top 100 African Woman by OkayAfrica – New York, USA

Facebook Group Impact award OLX Social Media Awards – Nairobi, Kenya

Health & Fitness Coach Award Africa Women’s Leader Awards – Victoria, Seychelles

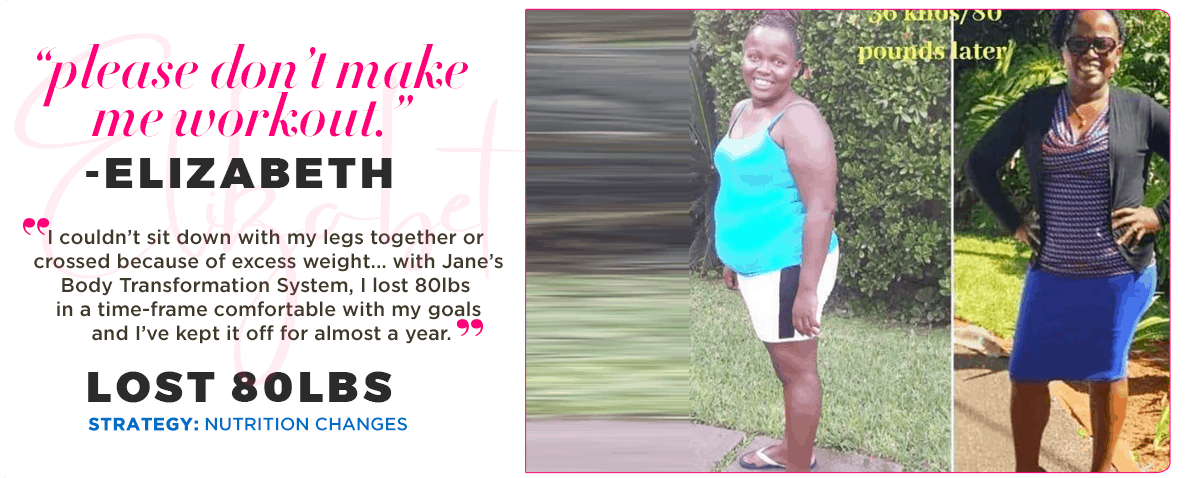

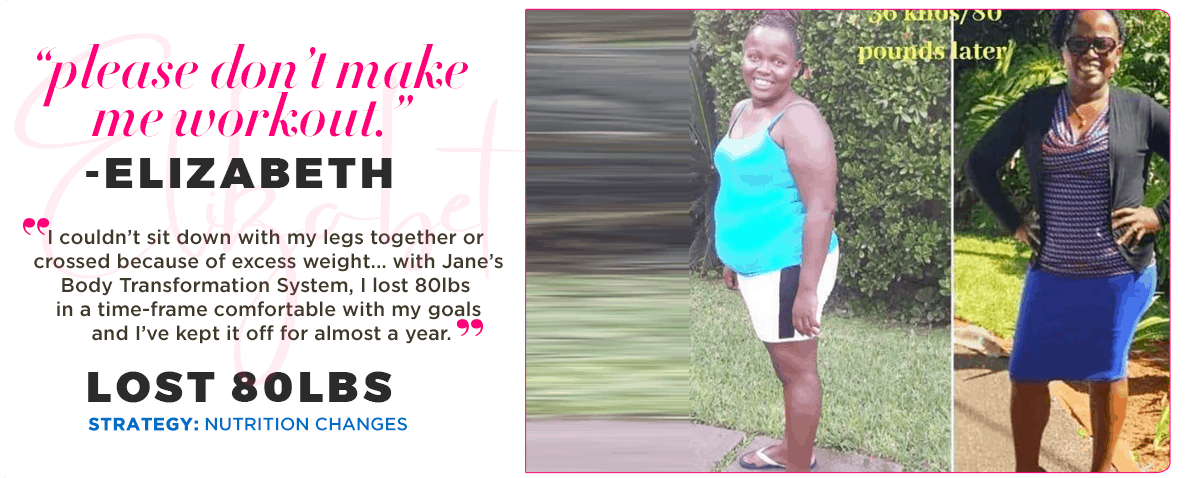

TESTIMONIALS

JANE MUKAMI

WHO IN THE WORLD IS JANE?

I was born and raised in Nairobi, Kenya and moved to Atlanta, GA in November 1999 in pursuit of higher education.

After divorce in 2008, I struggled with low self-confidence, self-worth, plummeted into depression and turned to food for comfort. A rude awakening made me commit to reclaiming myself by changing how I looked and how I felt.

My fitness journey transformed my body, my life and ignited my passion for health and fitness. I’ve since made it my mission to help women lose weight, look good, feel great, so that they can confidently live happy and exciting lives.

Achievements:

Creator of The P.U.S.H Weight Loss Method

Founder of 21 Days of Change – one of the largest health & fitness Facebook Groups for women with over 310,000 active members and other groups with a total of 625,000 members

250,000 combined Pounds lost over the last 4 years from 21,000 members

Certified health coach from Health Coach Institute US

Awards & Recognition:

Health & Fitness Award 2019 ACHI Awards – Atlanta USA

Influencer Award 2019 Journey Awards – Atlanta USA

Named Top 100 African Woman by OkayAfrica – New York, USA

Facebook Group Impact award OLX Social Media Awards – Nairobi, Kenya

Health & Fitness Coach Award Africa Women’s Leader Awards – Victoria, Seychelles

TESTIMONIALS

Body Transformation

![]()

A 12-week, nutrition-based weight-loss coaching program for women who finally want to lose weight once and for all and achieve their dream body, without working out or eliminating carbs or any food groups.

Health Restoration

![]()

38% of American adults are affected by obesity, causing a spike in lifestyle and chronic diseases, type 2 diabetes, high blood pressure and cancer. My goal: partner with medical doctors and patients to manage lifestyle diseases.

Book Me To Speak

![]()

If you’re looking for someone with first-hand experience in transformation, and an engaging message that inspires your audience to take mind and body action that can change their lives, book me to speak at your next event.

WORK WITH ME

Body Transformation

![]()

A 12-week, nutrition-based weight-loss coaching program for women who finally want to lose weight once and for all and achieve their dream body, without working out or eliminating carbs or any food groups.

Health Restoration

![]()

38% of American adults are affected by obesity, causing a spike in lifestyle and chronic diseases, type 2 diabetes, high blood pressure and cancer. My goal: partner with medical doctors and patients to manage lifestyle diseases.

Book Me To Speak

![]()

If you’re looking for someone with first-hand experience in transformation, and an engaging message that inspires your audience to take mind and body action that can change their lives, book me to speak at your next event.

ARE YOU READY FOR YOUR

TRANSFORMATION?

Are you ready to finally stop yo-yo dieting and have a solution that works, and is sustainable?

Are you ready to rock your old smaller clothes, without Spanx or other body products and enjoy shopping again?

Are you ready to enjoy dating, hanging out with friends and family, and taking happy selfies?

Are you ready to wake up feeling energized, have a great day at work, play with your children and reignite your sex life?

Are you ready to finally feel comfortable in your own skin?

It’s time to

Look Good and Feel Great

#lookgoodfeelgreat

ARE YOU READY FOR YOUR

TRANSFORMATION?

Are you ready to finally stop yo-yo dieting and have a solution that works, and is sustainable?

Are you ready to rock your old smaller clothes without Spanx or other body products, and enjoy shopping again?

Are you ready to enjoy dating, hanging out with friends and family, and taking happy selfies?

Are you ready to wake up feeling energized, have a great day at work, play with your children and reignite your sex life?

Are you ready to finally feel comfortable in your own skin?

It’s time to

Look Good and Feel Great

#lookgoodfeelgreat

Lynn

“I can’t believe that I am losing weight while eating carbohydrates and even when I haven’t worked out in 2 weeks. Also, I just noticed since Monday that the swelling on my ankle has really gone down and I’m guessing all this was caused by the food I was eating. Your program is truly amazing…”

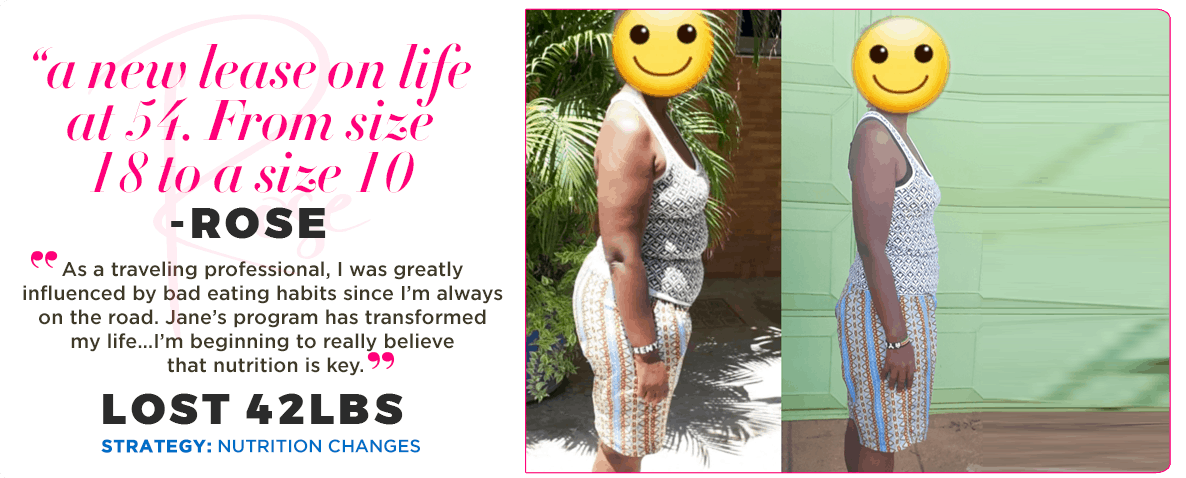

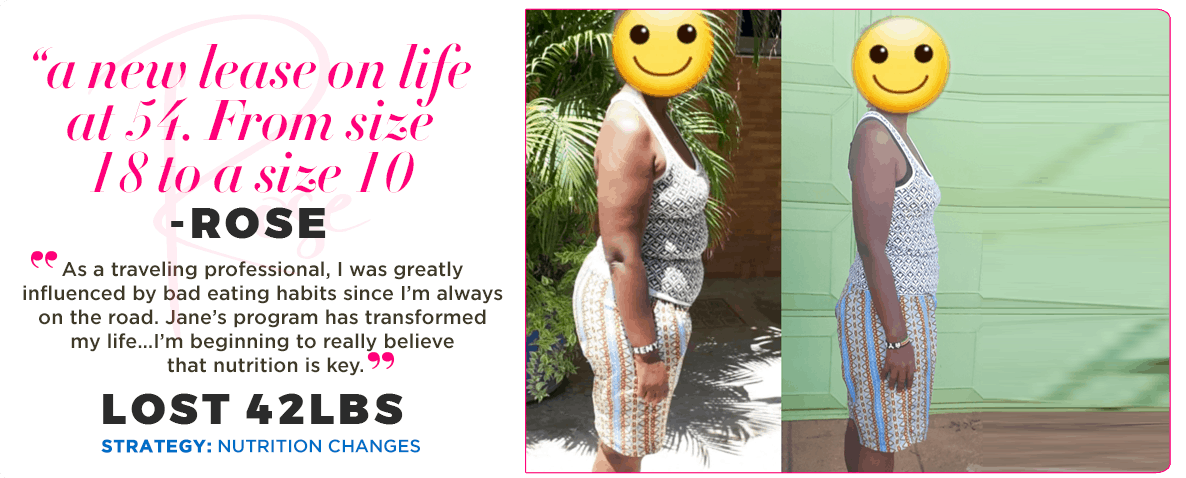

Rose

“The results on the scale were such a pleasant surprise. I always thought one can only lose weight while exercising. I am motivated to focus on the program and beginning to really believe that nutrition is key”

Stella

“Before Jane’s coaching program I felt Heavy, uncomfortable in my clothes, lethargic, unhappy with what I saw in the mirror. Now, all my clothes fit well and my ring is looser. You have taught me how to eat clean, moderation and how to enjoy ‘sinful’ treats even while losing weight. This is such a thorough and comprehensive program and I would recommend it to anyone that is serious about achieving their goals”

Mercy

“When I started working I Jane I felt stuck. I had tried to lose and keep off weight but nothing worked. I’ve learned that weight loss starts with the mind – once you decide to make healthy choices, have a solid why. With Jane’s plan making healthy decisions, with accountability from her guarantees great results”

Sylvia

“I am generally active in my life, but I wanted to know how to eat right and lose weight. l lost 18 pounds [9 kilos and lost a total of 18 inches. I am now wearing clothes that I last wore in 2015-2017 and feeling lighter and of course loving new me!!! Jane has really shown me that we are what we eat and that losing weight begins in the kitchen amongst many more invaluable lessons”

Mary

“ I used to feel Fat. Not sleeping well. Bloated. Tired. Now I feel Amazing. Confident. Like I could conquer the world!! Jane has taught me that weight loss, first of all, is a science. That it all begins in the mind and if you conquer your mindset there is nothing you can’t do!! He guidance has been priceless”

BLOG

All About Supplements

Are you curious about supplements? Are you curious about supplements? What are they? Should you take supplements? If so, why? Does supplementing help with weight loss? What supplements should you take and when? Click the image below to watch the video and please leave...

Carbohydrates & Weight Loss: Part 2

My last article was an overview of carbohydrates, different types & examples of each - (If you haven't read Carbohydrates & Weight Loss Part 1 please click here before proceeding -> https://iamjanemukami.com/caborhydrates-weight-loss-part-1/) Defining terms...

Caborhydrates & Weight Loss: Part 1

There is so much confusion on nutrition and it's costing you your health. I get asked questions like "Is spinach or cauliflower a carb?" There is more to this story but before I dive is... The food industry has programmed our brains with info that causes even more...

Transformation tips

Receive transformative hacks, advice and tips in your inbox, every week as part of JTN (Jane's Transformation Nation). JTN is 78,000 strong.

Transformation tips

Transformation tips

Receive transformative hacks, advice and tips in your inbox, every week as part of JTN (Jane’s Transformation Nation). JTN is 78,000 strong.

stay connected ON

TWITTER

[insta-gallery id="1"]